Company information

| Corporate name | Korea Institute For Education & Evaluation Advancement Corp | capital | one thousand |

|---|---|---|---|

| Dates of establishment | May 18, 2021 | Settlement of accounts period | December |

| listing day | Expected | Total capital | 537,612,000 |

| CEO | Seong Dae Geun | The address of the headquarters | 4th floor, Flower Mall Building, 145 Sin-daero, Jeju-si, Jeju-si, Jeju-do, 63134, zip code |

| Representative business type | Educational Advisory and Evaluation / Academic, Research Services / Natural Science R&D | The representative call | +82 - 64- 744 -2993 |

Organization Status of the Board of Directors

| Position | Name | the day of appointed | Terms | Whether to subscribe to liability insurance for damages to directors |

|---|---|---|---|---|

| CEO | Seong Dae Geun | May 18, 2021 | 3 years | join |

| director | Kang Byung sam | May 18, 2021 | 3 years | join |

The operation status of the board of directors

| Date | The main agenda | Whether be passed | The number of participants |

|---|---|---|---|

| 2021-05-17 | 1. Appointment of an outside director (Candidate: Jeong Song ki and 10 others) | be passed | 3/3(100%) |

| 2021-05-17 | 2. Approval of the use of the board of directors' corporate card | be passed | 3/3(100%) |

Article of Incorporation, Regulations of the board of directors. , Corporate Governance Charter

| Article of Incorporation | Regulations of the board of directors | Corporate Governance Charter |

|---|---|---|

| DOWNLOAD | DOWNLOAD | DOWNLOAD |

Differences between exemplary standards and Corporate Governance

| Recommendations for exemplary standards | Whether adopted | Remark |

|---|---|---|

| adoption of Corporate Governance Charter | introduction | |

| adoption of Ethics regulations for employees | not introduced | |

| Adoption of the intensive voting system and Disclosure Whether adopted | not introduced | |

| Composition of the board of directors (The majority outside directors) | not introduced | |

| Separation of the CEO and the chairman of the board of directors or Appointment of a senior outside director. | not introduced | |

| Disclosure of the pros and cons of the board of directors' activities, attendance rate, and major agenda items. | introduction | |

| Formation of the Outside Director Candidate Recommendation Committee. | not introduced | |

| composition of Compensation committee. | not introduced | |

| composition of audit committee(All outside directors.) | not introduced | |

| adoption of regulations on the roles and operating procedures of the board of directors and various committees. | introduction | |

| Subscribe to the liability insurance of the director at the company's expense. | introduction | |

| Evaluation of activities of the board of directors. | not introduced | |

| Maintaining the independence of external auditors. | not introduced | |

| Certification of accuracy and completeness of financial reporting by the CEO and financial manager. | not introduced | |

| Explain the difference between exemplary standards | introduction | |

| Audit reports and important Frequent disclosure notice disclosures in Korean and English. | not introduced | Korean disclosure |

1st regular general shareholders' meeting

| Number of shares issued | 179,204 |

|---|---|

| Number of stocks with voting rights | 179,204 |

| Number of shares attending the shareholders' meeting (exercise of voting rights) | 103,334 |

| The number of shares of major shareholders and related parties among the number of shares attending the shareholders' meeting (exercise of voting rights) | 43,334 |

| The number of shares other than major shareholders and related parties among the number of shares attending the shareholders' meeting (exercise of voting rights) | 32,536 |

| Status of voting rights in the number of shares other than major shareholders and related parties among the number of shares attending the shareholders' meeting (exercise of voting rights) | 81.9% |

| The current situation of ayes and noes of each agenda | Agreement | Opposition | Remark |

|---|---|---|---|

| Ratio to the number of shares Attend | Ratio to the number of shares Attend | ||

| Agenda No. 1: Appointment of an outside director (Candidate: Jeong Song-ki and 10 others) | 81% | 19% | be passed with the original plan |

| Agenda No. 2: Approval of the use of the board of directors' corporate card | 81% | 19% | be passed with the original plan |

| categorize | Dividend per share (won) | Dividends (100 million) | Dividend rate (based par value) | The market dividend rate | Dividend propensity |

|---|---|---|---|---|---|

| 2021 year | 500 | Expected | Expected | Expected | Expected |

- KIEEA dividends can only be received if you hold stocks as of the end of dividends as of March, June, September, and December.

- The dividend payment date may be a difference from one day to two days, and can be received around 5, 8, 11, and April, about two months later.

(However, dividends of December are paid in April, after the shareholders' meeting in March.)

- The dividend payment date may be a difference from one day to two days, and can be received around 5, 8, 11, and April, about two months later.

(However, dividends of December are paid in April, after the shareholders' meeting in March.)

KIEEA Quarterly Dividend Payment Schedule

| Dividend base date | payment day | |

|---|---|---|

| 1 quarter | end of March | May 20 |

| 2 quarters | end of June | August 20 |

| 3 quarters | end of september | November 20 |

| 4 quarters | end of december | April 20 |

| Types of stocks | Total number of shares issued | Total par value | Remark |

|---|---|---|---|

| common stock | 179,204 | 537,612,000 | face value 500 |

| total | 179,204 | 537,612,000 |

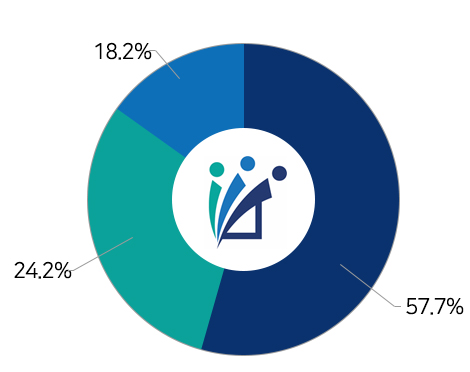

present situation of Composition of shareholders (in August 2021)

| categorize | The number of stock | Ratio |

|---|---|---|

| ■ Other than the largest shareholder | 103,334 | 57.7% |

| ■ individual | 43,334 | 24.2% |

| ■ Individual minority shareholder | 32,536 | 18.2% |

| total | 179,204 | 100% |

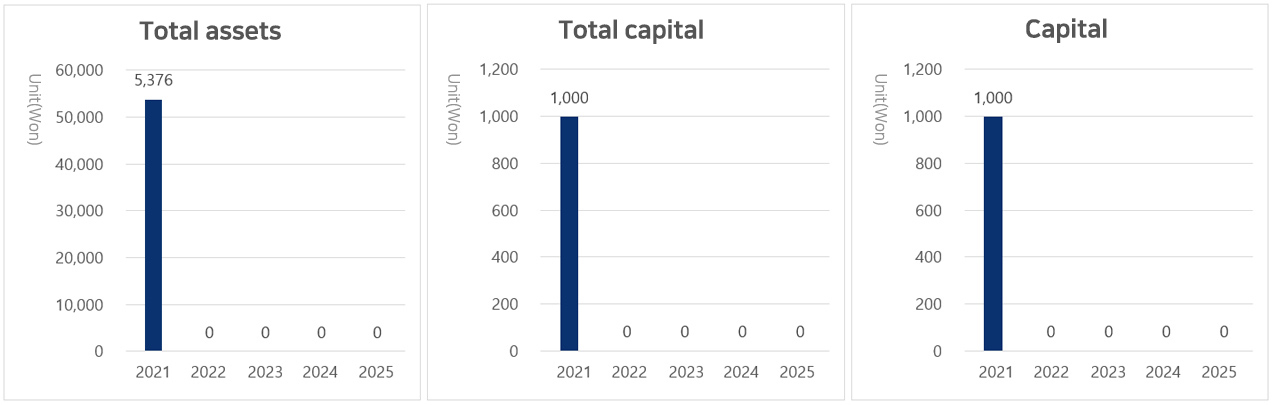

balance sheet

| categorize | 2021 year | 2022 year | 2023 year | 2024 year | 2025 year |

|---|---|---|---|---|---|

| Total assets | 537,612,000 | ||||

| liquid assets | - | ||||

| fixed assets | - | ||||

| Total amount of debt | - | ||||

| liquid debt | - | ||||

| fixed debt | - | ||||

| Total capital | 1,000 | ||||

| Capital | 1,000 |

income statement

| categorize | 2021 year | 2022 year | 2023 year | 2024 year | 2025 year |

|---|---|---|---|---|---|

| Sales | |||||

| Cost of sales | |||||

| gross margin from sales | |||||

| Sales and administrative expenses | |||||

| operating profit | |||||

| Other profits | |||||

| Other expenses | |||||

| Net profit before deducting corporate tax | |||||

| Corporate tax expense | |||||

| net profit during the term |

Financial status